I decided to address this issue in a blog since I get asked ALL the time. Banks make a profit based in part by collecting interest. The interest rates banks charge vary from consumer to consumer based on the risk of the individual consumer.

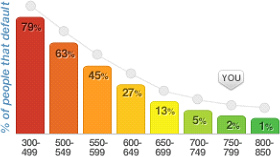

As an example, a consumer with a 400 FICO score is at a VERY high risk of future default. As a matter of fact, an estimated 79% of consumers with a 400 FICO score are expected to default within 24 months. With such a high risk of default, most banks won’t approve any credit regardless of the interest rate. Just think about it, how can The First National Bank of Santa Clause go wrong by charging 30% interest to high-risk borrowers. The fact is, any bank will go out of business if 79% of their clients don’t pay their debts.

Let’s discover why consumers with very high credit scores pay less interest. Only 1% of consumers with a FICO score over 800 are expected to default over the next 24 months. Banks know 99% of these consumers will pay their debts so the risk is very low. Low risk equals low-interest rates.

The graph below provided by www.myfico.com provides an illustration of the percentage of expected defaults. The key word is “expected defaults”. A formula does not exist to determine who will default.

I hope this blog gives you a better understanding of the importance of maintaining a high credit score at all times.