Did you ever hear the saying that nothing is free?

Every consumer should be very careful on providing the numerous free credit/lending websites their personal information. So many consumers fail to understand that with the exception of annualcreditreport.com, most, if not all, of the free credit/lending providers are actually marketing companies. These marketing companies use your personal information to make you credit offers; they then make money when you apply for and/or open new credit. Seeing that I educate consumers on how to improve their credit, I subscribe to a number of these free sites purely to understand how they operate so I can better warn consumers of some of their pitfalls. I now get MANY emails daily about applying for loans, getting out of debt, how to better manage my money and how my credit score changed. REALLY? I have an A+ credit score and I have no revolving debt. I have ZERO need for these companies’ advice. Since I know better, these marketing companies don’t make money off of me.

At Cure My Score, we often have clients who complain about having unauthorized credit inquiries. At times, they fear their data was hacked and an ID Thief was trying to steal from them. Perhaps all they did was unknowingly apply for credit?

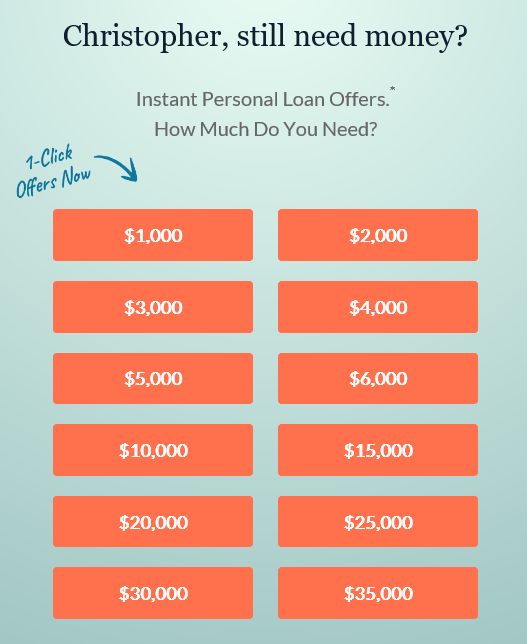

Below is a photo from an email I received today from one of these free web marketers. I cut off the bottom of the email where in part, it displayed my entire name, address and the month and year of my birth.

As a consumer, I have a number of issues with this email, as well as with the many other similar emails I get daily.

- I never asked for, needed or requested money from this site. I find it odd asking me if I still need money. I assume they want the catchy question in LARGE PRINT as well as the email subject line.

- If I were to click on any dollar amount in this email, whether by accident or out of curiosity for more information, they will consider that single click as an application. They may instantly send my personal information to up to 5 lenders who can then obtain my credit and solicit me with loan offers.

- In the fine print of this email it discloses “In order to provide you with an expediated loan process, we are submitting the following information to our network of lenders:”, they then display my name, address and birth date.

- In the super fine print it states “By using 1-Click and clicking on a loan amount above, you consent and agree to the following:”; part of this consent is agreeing that to up to 5 lenders may obtain my credit report or other infromation from the credit bureau(s) about me.

- The email itself provides a great deal of my personal information. If my email were to be hacked, I would not want a hacker to have access to this email containing my personal information.

I don’t want a marketing company to send my personal information to their “network” of lenders.

I don’t know if this network of lenders will make hard credit inquiries which will hurt my credit score nor do I know what they will do with my personal information.

Let me be very clear, if I want to borrow money for any reason, I will choose the bank I want to deal with and inquire about any loan options that serve my needs. If I then decide to request a loan, I will take the few minutes that it takes and apply for it and knowingly give consent to have my credit pulled. I will know what bank I am dealing with and who I am choose to share my personal data with.

If you provided your personal information to any of these free websites, you have the option to contact them and unsubcribe to their services. Some of the free websites that give your regular access to your credit reports can be beneficial if you are in the process of repairing your credit. If this is the case, consumers should be very careful on what links they click.

CREDIT REPAIR HELP IS AVAILABLE.

If your credit needs some help like this client, take action. There are a lot of resources available on steps to improve your credit. You can get free information from the FTC or contact a professional credit repair company like CureMyScore.com for help. By taking action to improve your credit, you may qualify for the home of your dreams or a new auto while paying less in interest charges.

Call us at 412-564-5370 with any questions / comments or schedule a free program review. Like us on Facebook to receive future consumer credit tips.